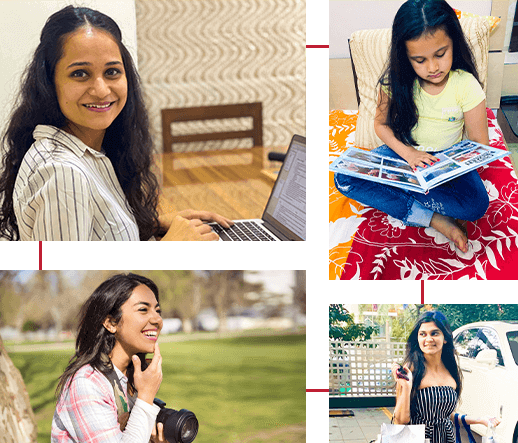

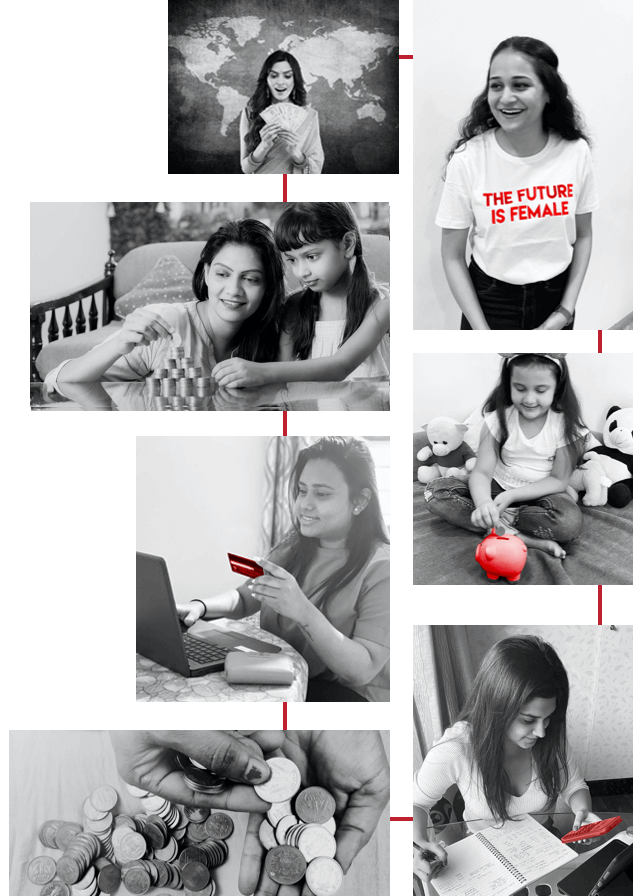

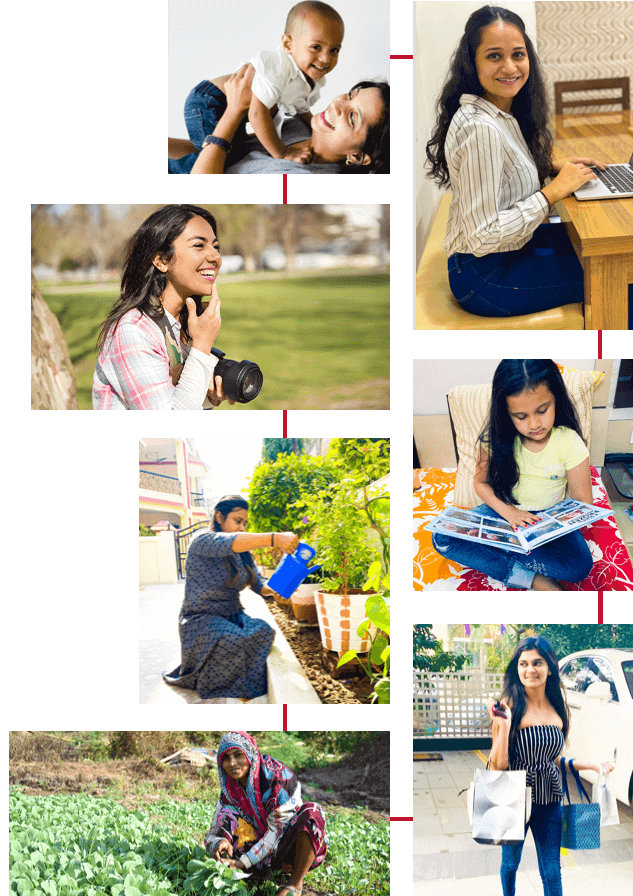

WE BELIEVE IN

STREE POWER!

Women are magic makers who can accomplish the

impossible and yet when it comes to financial

decisions, they usually take a back seat.

Not Anymore!

Presenting: BFF (Buddy For Finance)