A Guide to Mutual Fund Risks: Understanding the Riskometer

In the world of mutual funds, it's crucial to grasp the concept of risk before investing your money. To help with this, the Securities and Exchange Board of India (SEBI) introduced a tool called the Riskometer. This article aims to explain what the Riskometer is, what its different levels mean, and where you can find it.

Understanding the Riskometer

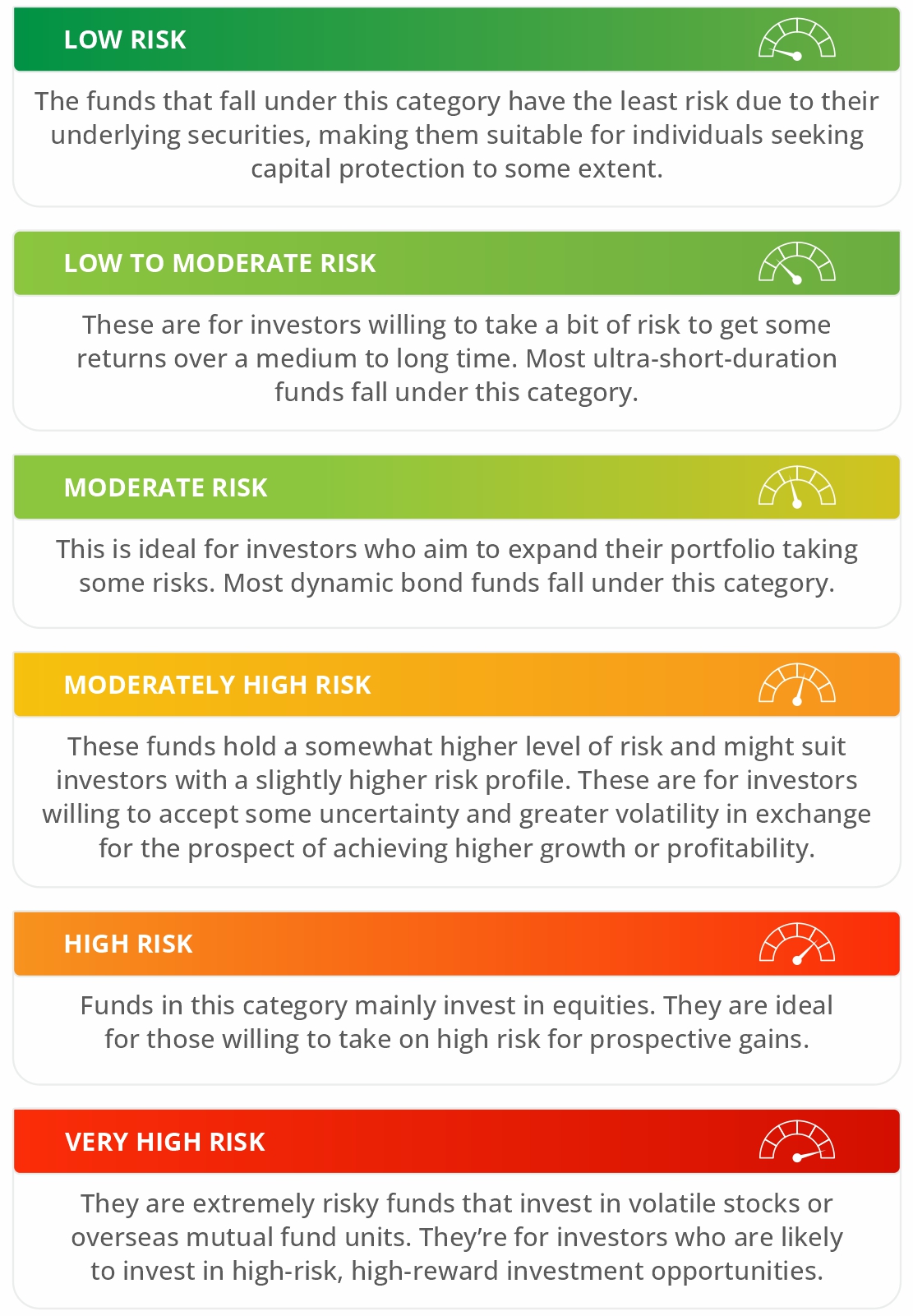

The Riskometer is a tool created by SEBI to show how risky a mutual fund scheme is. It helps investors see if a scheme matches their comfort level with risk. By dividing schemes into different risk levels, the Riskometer helps investors make smarter choices based on their own risk preferences and financial goals.

Exploring Different Risk Levels

Where can you find the Riskometer?

You can find the Riskometer in documents like scheme information documents (SIDs) and key information memorandums (KIMs) provided by mutual fund companies. It's also available on their websites, along with other important details about each scheme. Financial advisors and mutual fund distributors can help explain the Riskometer and guide investors in choosing the right scheme.

Understanding risk is key to successful investing in mutual funds. The Riskometer, mandated by SEBI, provides a simple way to assess the risk of different mutual fund schemes. By understanding the risk levels and aligning them with your own risk tolerance and financial goals, you can make informed investment decisions that suit your needs.

Disclaimer: Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.

Source for risk levels: https://www.mutualfundssahihai.com/

Do you have any questions? Write to us